Table of Content

In total, four of the top 10 mortgage lenders in Hawaii are based out of Honolulu. Not surprising as local names tend to do the most business there. In general, there are fewer mortgage companies operating in the state of Hawaii, so you tend to see only the bigger household names along with local banks and credit unions. First Hawaiian Bank products and services are not available for residents of the European Union.

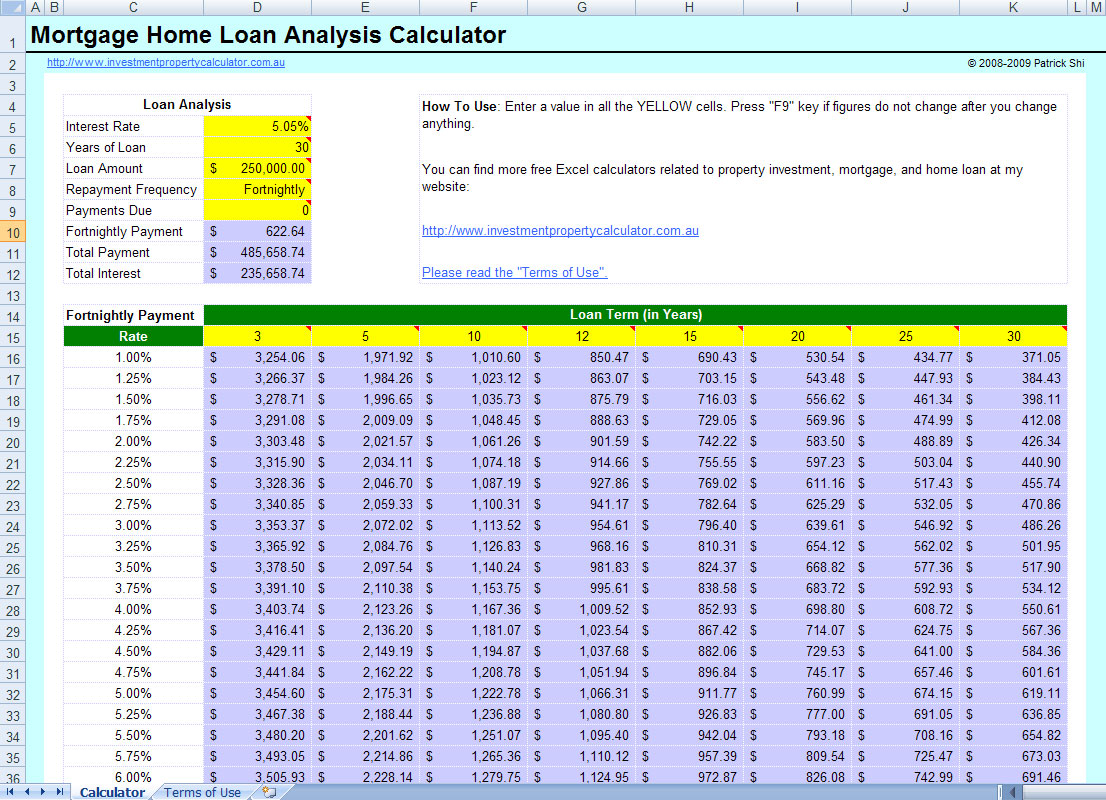

The results of the mortgage calculator give you a first impression of your mortgage possibilities and help you to get orientated. It is a sample calculation that shows an overview of your expected costs. However, our calculator does not replace a personal consultation. A HELOC will usually have a variable interest rate, which changes with the market rate.

USDA Loans Hawaii

I typically turn to Zillow for customer reviews as they are entirely mortgage-centric, even for banks and credit unions that offer other non-mortgage products. Mortgage points, sometimes known as discount fees or “paying down the rate,” are fees you pay your mortgage lender up front in exchange for a lower interest rate on your new mortgage. Paying points to your lender now allows you to pay less interest on your loan over time. Your DTI ratio is the percentage of your gross monthly income, before taxes, that goes toward your current rent , credit cards, student loans and other debt. 1Interest rates and payments may increase after consummation.

APR’s are calculated using a base loan amount of $200,000 and assume active duty status with first time use of V.A. A financial services company known primarily for its credit cards, Discover also offers home equity loans as part of its suite of banking products. Home equity loans are available in 48 states, but the lender does not offer home equity lines of credit at all. For Discover’s home equity loans, possible loan amounts range from $35,000 to $300,000. The lender charges no origination fees, application fees, appraisal fees, and mortgage taxes. There are no closing costs on home equity loans or HELOCs from U.S.

Best HELOC and Home Equity Lenders in Hawaii

Under certain conditions, it is also possible to finance a property without equity. These include, for example, a very good credit rating, a very high income, and an excellent location of the property. However, the bank will charge significantly higher interest. Our engine combines modern finance theory with practical insights from our team of mortgage brokers. "The best refinancing company that my wife and I ever experienced. Every step of the way was smooth sailing. Marla always kept us abreast throughout the process due to her professionalism and experience."

© 2022 NextAdvisor, LLC A Red Ventures Company All Rights Reserved. Use of this site constitutes acceptance of our Terms of Use, Privacy Policy and California Do Not Sell My Personal Information. NextAdvisor may receive compensation for some links to products and services on this website. To get the best interest rate, you’ll have to demonstrate you are not likely to miss a payment. A high credit score can accomplish that, and many lenders use your score in determining what rate you qualify for.

Your home loan in 4 easy steps

Today we’ll check out the top mortgage lenders in Hawaii based on total loan volume. Take advantage of our first-time homebuyer programs with lower down payment options. Our advanced technology compares mortgage options from over 400 German lender and our mortgage experts will explain each offer. Hypofriend GmbHis an independent mortgage broker certified with the §34i GewO supervised by BaFin. Hypofriend works together with over 750 partner banks to find customers the optimal mortgage.

After the initial fixed-rate period, your interest rate can increase or decrease annually according to the then current index. Special HELOC offer is subject to change or discontinuation at any time without notice. Offer only valid for completed applications received for new lines of credit - no refinances.

To help you, we’ve done the research and compiled a list of our top picks for the best home equity loan and HELOC lenders in Hawaii. Processing times vary depending on funding availability and program demand in the area in which an applicant is interested in buying and completeness of the application package. Applicants with assets higher than the asset limits may be required to use a portion of those assets. FHB Commercial Online, formerly known as OBC, is our powerful and easy to use online banking system for businesses. Our FHB Online and FHB Mobile services are currently unavailable.

Our knowledgeable Mortgage Loan Officers will work with you to make sure your experience is convenient and painless. Finding the perfect mortgage to go with the perfect home is easy at Hawaii State FCU. We’re here to help you buy a home in Hawaii. There are no other additional requirements at the national level. If there are additional state-specific requirements they will be listed above.

Available loan amounts for HELOCs and home equity loans range from $15,000 to $750,000, and up to $1 million for properties in California. Fixed interest rateThe longer you fix the interest rate, the more security you have in planning your mortgage loan. However, you also have to accept higher costs, because the longer the fixed interest rate, the higher the interest rate that the bank will call. With a short fixed interest rate period, on the other hand, you benefit from a lower interest rate. But you take a risk as a higher loan balance remains at the end of the fixed interest rate and you may have to take out significantly higher refinancing for it.

Bank, but you’ll be charged an early closure fee of 1% of the line amount ($500 max) if you close your HELOC within 30 months of opening. In addition, HELOC borrowers may be charged an annual fee of up to $90, which can be waived with a U.S. U.S. Bank offers a rate discount of 0.5% for home equity loan borrowers who set up automatic payments from a U.S. 1 The promotion is valid only when you apply online using SimpliFi by Bank of Hawaii for home purchase loans pre-qualified prior to application date, refinanced mortgages from another bank and new mortgages. Mortgage loan application must be received by March 31, 2023.

Our Mortgage Loan Officers will work you step by step through the mortgage process. Looking for a loan but don’t have any funds for a down payment? Combine a Conventional First Mortgage Loan with a Combo 100 Home Equity Line of Credit and we’ll help you finance 100% of your home up to $750,000. That means half of the top 10 home purchase lenders in the state of Hawaii are based in Hawaii. A mortgage loan for designated essential workers and degreed professionals. Links to other sites are provided as a service to you by Bank of Hawaii.

FHA insures loans made to native Hawaiians to purchase one- to four-family dwellings located on Hawaiian home lands . Adjustable-rate mortgages usually have lower starting interest rates, compared with fixed-rate mortgages. However, with an adjustable-rate mortgage, your interest rate—and monthly payments—can change as interest rates fluctuate.

No comments:

Post a Comment